When Christian investors focus solely on avoiding unethical causes, they miss a chance to build up good corporations and ministries.

In 1971, the Episcopal Church ignited modern “values investing” when it challenged General Motors’ policies in apartheid South Africa. Holding a meager 0.004 percent of shares, the church introduced a board resolution (alongside Black pastor and GM board member Leon Sullivan) that sparked a movement and changed corporate America’s approach to apartheid.

Those Christian activist investors were building on a long legacy of faith-aligned financial management, stretching from Jewish law to John Wesley’s admonitions against investing in alcohol and tobacco. But over the past 50 years, the church’s approach to values-aligned investing has stagnated even as the mainstream world has fully embraced the concept.

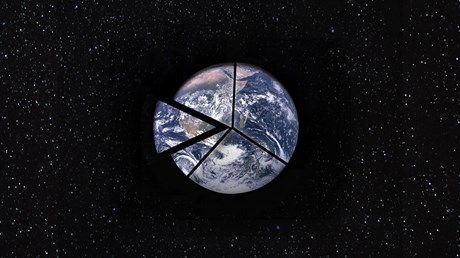

In 2020, there was approximately $106 trillion in managed assets around the world, and at least $35 trillion of that was in “ESG” mandates—those with some explicit focus on environmental, social, or governance concerns. Most major investment and wealth managers now have clear ESG policies and capabilities with defined agendas, sometimes under alternative monikers like “responsible” or “ethical” investing or corporate social responsibility (CSR).

Asset management firms like Blackrock, State Street, and Vanguard—which collectively own almost 20 percent of the S&P 500—regularly push companies to adopt environmental or social policies aligned with their agendas.

The sovereign wealth funds of countries like New Zealand, Norway, China, and Saudi Arabia shape companies and policies all over the world. And huge US pension plans like CalSTRS and the New York State Common Retirement Fund often enforce new policies on asset managers and companies ...

from Christianity Today Magazine

Umn ministry

.gif)

.gif)

.gif)